23+ buy down mortgage rate

This 3000 is in addition to all other traditional fees. The average cost of a 15-year fixed-rate mortgage has also.

How Does Mortgage Rate Buydown Work The Washington Post

Web We offer five types of Temporary Buydowns through Rate Reduce.

. If you bought a 450000 home with a 20 down payment for a loan amount of 360000 with a 30 year term at a fixed rate of 6125 Annual Percentage Rate 6220 you would make 360 payments of. The points paid upfront reduce the interest rate by 1 for each of those first 3 years. Youll notice that their names correspond with the periods of lower ratesso a 3-2-1.

Web The average rate on the popular 30-year fixed mortgage dropped to 657 on Monday according to Mortgage News Daily. The 30-year fixed-rate mortgage is the most common type of home loan. Say youre borrowing 250000 with a 30-year fixed-rate loan at 675.

Web Our Buydown program helps you reduce your interest rate and lower your monthly housing payment in the first 1-3 years of your loan. Web A 2-1 buy-down means that during the first year of your mortgage the interest rate youll pay will be 2 below market. Web And the rate of 6375 actually results in a lender credit which is the opposite of a buy down because you get money back to cover closing costs.

Web 2 days agoHow mortgage rates have changed over time. Web Consult a financial professional for full details. The rate is typically two.

Web Stable monthly payments make budgeting easier. You can choose between a 2-1 buydown or a 3-2-1 buydown. As a homebuyer higher rates means paying more interest.

Heres what that looks like for a 350000. Web With a 2-1 buydown the mortgage rate and monthly payments are reduced for the first year of the loan and rise in the second year reaching the terminal rate in the third year. Web With this type of buydown youre buying a rate that is 3 below the prevailing mortgage.

Check todays mortgage rates on Zillow. Web Mortgage Rates Forecast Through March 2023 Experts are forecasting that the 30-year fixed-mortgage rate will stay within the 5 to 6 range in later 2023 though some predict it might go. Web A 2-1 mortgage buydown is similar to the 3-2-1 structure except the discounted rate is only for the first two years of the loans term.

Thats down from a rate of 676 on Friday and a recent high of 705 last. In the second year it will be 1 lower. The most common is called a 2-1 buydown but theres also a 3-2-1 buydown 1-1-1 buydown 1-0 buydown and 15-05 buydown.

Web With a 2-1 buydown a 625 mortgage rate would be cut to 425 the first year increase to 525 in year two and return to 625 in the third year. Web Current Mortgage Rate Trends The average mortgage rate for a 30-year fixed is 698 a steep climb from 322 in early 2022. This would give the buyer an interest rate that is 2 less than the standard rate in.

This is an increase from the previous week. Web 1 day agoThe current average 30-year fixed mortgage rate is 673 according to Freddie Mac. But if you want a rate of 5875 youd need to pay one mortgage point.

You dont have to be an economic expert to know that interest rates can jump up at a moments notice. Web A mortgage point typically costs around 1 of your mortgage loan amount according to GOBankingRates and reduces your interest rate by 025. Heres the gist of how that.

Web Consult a financial professional for full details. Web Jan 23 2023. A month ago the average rate on a 30-year fixed refinance was lower at 687 percent.

They all offer a period of time with a lower rate and work similarly. The Benefit of a 3-2-1 Buydown One benefit of this type of buydown is that the borrower can qualify for the loan at the 375 interest rate and the payment amount of 1670 versus the real rate of 675 and the payment of 2270. Lets say a buyer wants to borrow 400000 and qualifies for a 30-year fully amortized mortgage at an interest rate of 5.

One way to guard against unwelcome surprises is with a fixed-rate mortgage that features predictable monthly payments for the life of the loan. The 3000 lowers your rate by 25 percent which lowers your payment 44 per month and lowers your interest cost 6250 per month. Otherwise known as buying mortgage points or discount points.

The process of buying down your mortgage rate involves paying an extra upfront fee to your lender at closing to secure a lower interest rate and monthly payment for the entire length of your mortgage. Use our refinance calculator to determine how much money you could save with a refinance loan from Cherry Creek Mortgage. Simply put a mortgage rate buy-down is upfront money often paid by the home seller builders and lenders can also front the cost to buy down the.

Web A 2-1 buydown is a type of financing that lowers the interest rate on a mortgage for the first two years before it rises to the regular permanent rate. Our tool will help you. Web What does buying down the mortgage rate mean.

Web The average 30-year fixed-refinance rate is 697 percent down 11 basis points over the last week. Web Here are some examples of how a buydown mortgage can work. If you bought a 450000 home with a 20 down payment for a loan amount of 360000 with a 30 year term at a fixed rate of 6125 Annual Percentage Rate 6220 you.

Todays mortgage interest rates are well below the highest annual average rate recorded by Freddie Mac 1663 in 1981. So if you put down an extra 4 in the form of. Web In this example the points would be 3000 because theyre equivalent to 1 percent of the loan amount.

Use this calculator to determine how much you can save. Web A 3-2-1 buydown enables a buyer to pay less interest on their mortgage for 3 years after obtaining the loan. Web It costs 15853 to buy down the interest rate and payments for three full years.

Buy Galaxy S23 Ultra 1tb Unlocked Phones Samsung Us

What Is A Mortgage Rate Buydown Gobankingrates

8 12 22 Spy Es Futures And Apple Weekly Analysis And Market Recap R Wallstreetbets

Buying Down The Rate Loan Officer Kevin O Connor

Open Esds

20k In Debt But Decent Income What To Do R Eu4

Mortgage Rates Tumble As Lenders Face Increasing Difficulties The Washington Post

Hi India November 23 2018 By Hi India Weekly Issuu

Mortgage Rates Tumble As Lenders Face Increasing Difficulties The Washington Post

Buydown Mortgage How To Reduce Prevailing Interest Rates

5 Year Fixed Mortgage Rates And Loan Programs

Vocational Education And Training In Europe Iceland Cedefop

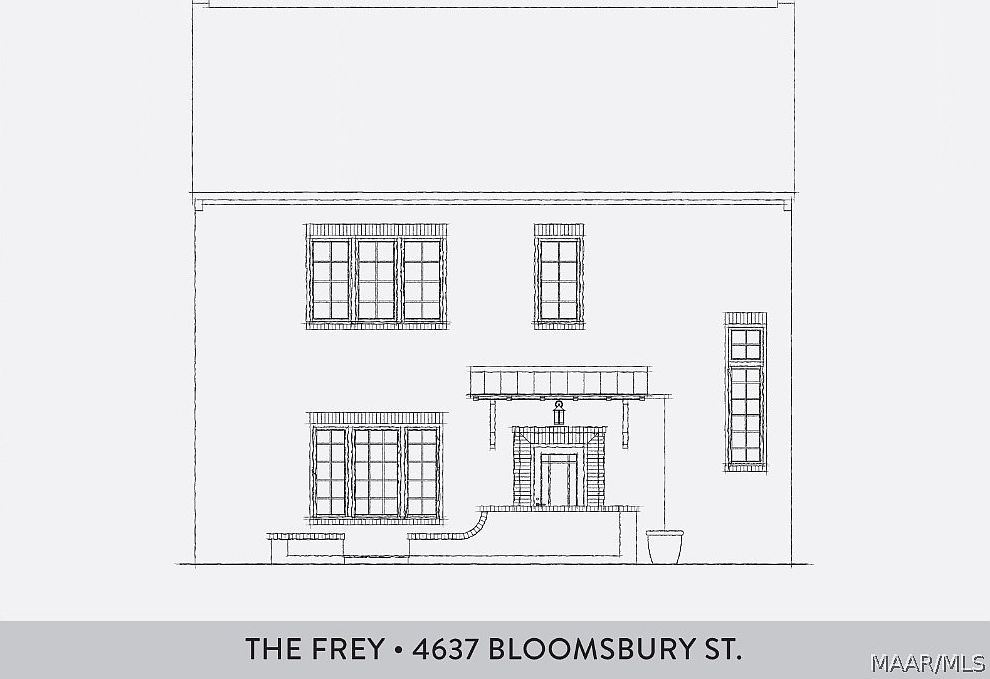

4637 Bloomsbury St Montgomery Al 36116 Mls 529779 Zillow

How Does Mortgage Rate Buydown Work The Washington Post

Buydown A Way To Reduce Interest Rates Rocket Mortgage

Moneysprite London

50 Personal Finance Terms Everyone Needs To Know